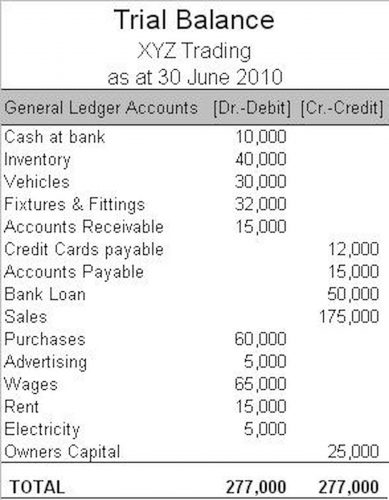

Vertical analysis and horizontal analysis are both techniques used to analyze financial statements, but they differ in the way they present information. Vertical Analysis refers to the income statement analysis where all the line items present in the company’s income statement are listed as a percentage of the sales within such a statement. It thus helps analyze the company’s performance by highlighting whether it is showing an upward or downward trend. This involves staying up to date with industry trends and evolving financial practices, as well as evaluating the outcomes of decisions influenced by this analysis. It can be used in the same way, identifying whether the current balance matches the strategy of the business, as well as looking at multiple years to identify trends and anomalies.

Balance Sheet Vertical Analysis: What It Is and How It Works

By leveraging these practical applications, you can harness the power of vertical analysis to enhance financial decision-making and improve overall business performance. Despite the various advantages, there are a few factors of vertical analysis accounting that prove to be a disadvantage. The vertical analysis provides several advantages to internal and external stakeholders of a company. With the help of vertical analysis, as shown above, we can argue that the net profit margin for Facebook remained similar to that of the previous year. Then, analysts can establish whether the financial metrics improved from the previous periods or not. Vertical analysis can also be used to compare the companies numbers to competitors vertical analysis formula or the industry averages.

E-Commerce Profit and Loss Statement

By expressing line items as percentages of a base figure, you can identify trends, assess proportions, and gain valuable insights into a company’s financial performance. Vertical analysis is a financial analysis technique that examines the proportions of each line item in the income statement relative to a base figure to evaluate a company’s financial statements. Additionally, the base amount is often the overall revenue or sales (for the time period under consideration). Hence, it determines the relative importance of various elements in financial statements and to find trends and patterns (further use to make financial decisions).

Importance of Vertical Analysis in Financial Analysis

Vertical analysis is a type of ratio analysis that presents each line on the financial statements as a percentage of another item. The frequency of conducting vertical analysis depends on the company’s reporting requirements and the need for financial analysis. https://www.bookstime.com/ It can be done quarterly, annually, or whenever there is a need to evaluate financial performance. Vertical analysis makes it much easier to read and compare the financial statements of one business to another. This is because you can see the relative percentages in relation to the numbers as well as each other.

- For example, if you see the various expense line items in the income statement as a percentage of sales.

- The vertical analysis helps forecast the changes in the line items in both positive and negative directions.

- Look for items with a significant percentage of Total Assets, as these could represent areas of vulnerability or strength.

- If they want to calculate their inventory, it would be 20% while using vertical analysis ($80,000 of the $400,000 total).

- You know how to do a vertical analysis with Excel and Google Sheets, using both an income statement and a balance sheet.

- In this example, the business’s variable expenses have trended downward over the three-year period.

- Through careful interpretation of vertical analysis results, you can gain valuable insights into a company’s financial performance, strengths, and areas for improvement.

- Vertical analysis is a technique used in financial statement analysis to show the relative size of each account compared to the total amount.

- Each item in the income statement is divided by the company’s total sales for that year (which gives us a common size income statement).

For example, if the sales revenue of a company is $10 million and the cost of sales is $6 million, the cost of sales will be reported as 60% of the sales revenue. Vertical analysis of a balance sheet can be a powerful tool to understand your company’s performance or how two businesses compare. Try it with your next financial analysis and see if it provides useful insights or helps you track progress toward goals. Do you want to take your financial analysis skills to the next level and get more detailed insight into your financial statements? Learning how to perform a vertical balance sheet analysis can equip you with the skills to extract actionable insights into your company’s current financial health. What makes vertical analysis stand out from other financial and profitability analysis methods is its emphasis on relative relationships.

- By analyzing the percentages of line items, you can make informed predictions and support strategic planning.

- Horizontal analysis differs slightly from vertical analysis in that it presents each item in the financial statements as a percentage of itself at an earlier period in time.

- Vertical analysis, often referred to as common-size analysis, is a crucial financial tool used in the world of business and finance to assess the relative proportions of different financial statement items.

- For example, on an income statement, the value of each revenue stream is a separate line item, which contributes to the total revenue.

- Vertical analysis (or common-size analysis) and horizontal analysis (also known as trend analysis) are two of the most commonly used tools in financial statement analysis.

It can be hard to compare the balance sheet of a $1 billion company with that of a $100 billion company. The common-sized accounts of vertical analysis make it possible to compare and contrast numbers of far different magnitudes in a meaningful way. By doing this, we’ll build a new income statement that shows each account as a percentage of the sales for that year. As an example, in year one we’ll divide the company’s “Salaries” expense, $95,000 by its sales for that year, $400,000. That result, 24%, will appear on the vertical analysis table beside Salaries for year one. For the balance sheet, the total assets of the company will show as 100%, with all the other accounts on both the assets and liabilities sides showing as a QuickBooks percentage of the total assets number.

However, while sales rose consistently from year 1 to 3, net income dropped markedly in year 3 so we would like to look into this in more detail. Once you know what time period to focus on, you need to choose the documents and values you want to analyze. For example, you could choose to study the contribution of each revenue stream to the total amount of revenue using the information from the balance sheet. For example, on an income statement, the value of each revenue stream is a separate line item, which contributes to the total revenue.

Vertical analysis looks at numbers in financial statements in the same period and calculates each line item as a percentage of the base figure in that section. In order to use the vertical analysis equation, you need to figure out your base figure. On a business’s balance sheet, you can find the relevant base figure as the company’s total assets or liabilities. Though this is dependent on what you are attempting to measure as different financial documents will have different base figures.